This morning I celebrated my 15th year at Virginia Tech! It’s hard to believe this much time has passed since arriving in Blacksburg for the start of the 2009 spring semester. In a nostalgic look back, I’ve included a few images below from my first few months at Virginia Tech.

Category: General Interest

Policy Pathways – Life Abroad

This weekend, I’ll be speaking about why international education matters at the Pathways to Life Abroad Fair hosted by Policy Pathways. If you live in Richmond, Virginia, please join us at the Huguenot High School between 10am and 2pm on Saturday, Aril 13. The event is open to the public.

Webinar – European Parliament Elections Briefing

On Thursday, April 11, from 4:00-5:30pm, Karolina Wozniak, Head of Press and Media in the European Parliament Liaison Office in Washington DC, will speak about the upcoming European elections. The European Union is one of the United States strongest and most valuable partners, meaning the elections can have a significant impact on US-EU policies. The event is hosted by the Center for European and Transatlantic Studies (CEUTS).

If you would like to join the webinar, please register here.

CFWPP Speaker Series: Applying for NSF Funding

On March 13 at 2pm, the Center for Future Work Places and Practices (CFWPP) will welcome Dr. Alan Tomkins – the Acting Division Director of the NSF’s Social and Economic Sciences (SES) Directorate – to Virginia Tech as part of its speaker series. In this presentation, Dr. Tomkins will talk about NSF’s grant process and Social, Behavioral, and Economic Sciences (SBE) programs, provide tips for writing a competitive proposal, and discuss different types of grants.

Please register here to join the talk in person or remotely.

Fall 2023 – SPIA Undergraduate Newsletter

Congratulations Shahidur Rashid Talukdar!

Congratulations to Shahidur Rashid Talukdar for successfully defending his PhD dissertation entitled “Policy conflicts among local government officials: How does officials’ engagement with regional governance relate to their position divergence on sustainability policy?” The abstract for his dissertation is provided below.

Shahidur will receive a Ph.D. in Public Administration and Public Affairs from the Center for Public Administration and Policy (CPAP) at Virginia Tech.

I served as a member of Shahidur’s doctoral committee, along with Prof. Karen Hult (Committee Chair), Dr. David Bredenkamp, and Dr. Stephanie Davis. It is customary in CPAP to hold PhD defenses in full academic regalia.

Abstract

Policy conflict plays an important role in shaping public policy—both as a process and as a product. The policy conflict framework—a relatively novel theoretical framework, developed by Christopher Weible and Tanya Heikkila in 2017—considers position divergence among policymakers a key characteristic of policy conflict, which can be affected several factors including organizational and network affiliation of policymakers. This dissertation analyzes position divergence among local and regional officials over community sustainability policy, with a focus on affordable housing, which is a major concern of community sustainability. This research examines if, and how, local government officials’ engagement with regional governance can play a role in shaping their policy positions. Understanding what influences officials’ policy positions is essential in managing conflicts that arise in the making of sustainability policies in general and affordable housing policies, in particular.

This study argues that local government officials’ engagement with regional governance can lower policy position divergence among them by influencing their policy core beliefs and policy relevant knowledge. This analysis includes testing several hypotheses using data from a state-wide survey of local and regional policymakers. Employing cross-tabulations, multivariate regressions, and ordered logit analysis, this study finds that (a) policymakers share a wide range of policy positions on community sustainability policies and (b) for local government officials engaged with regional governance, position divergence on community sustainability is lower than that among those who are not engaged with regional governance. Although position divergence on affordable housing among those engaged with regional governance is generally lower than those who are not engaged with regional governance, this finding is not robust. In some regions and localities, the relationship between position divergence and engagement with regional governance does not hold.

Furthermore, this study finds that local government officials’ engagement with regional governance is associated with higher levels of policy relevant knowledge, which can influence the policymakers’ policy positions. Policy core beliefs do not have a statistically significant relationship with policymakers’ engagement with regional governance. The analysis suggests that local government officials’ policy core beliefs may not be affected by their engagement with regional governance.

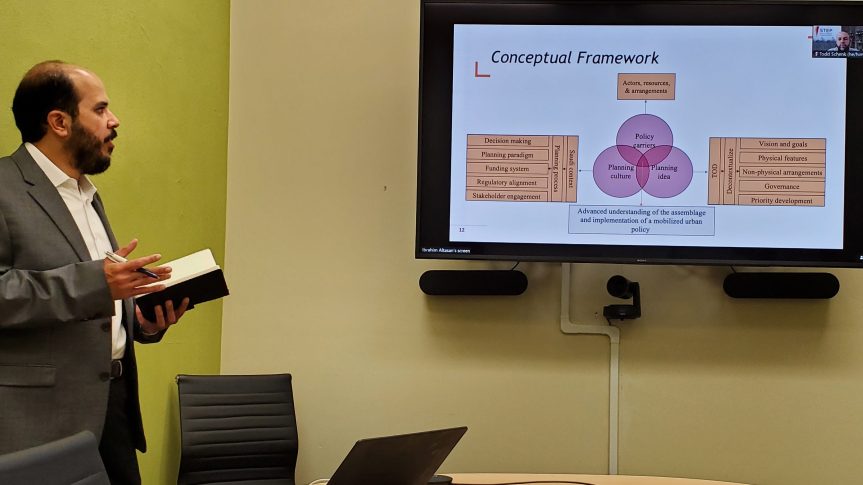

Congratuations Ibrahim Altasan (إبراهيم الطاسان)!

Congratulations to Ibrahim Altasan for successfully defending his PhD dissertation entitled “The Governance of Mobilized Urban Policies: The Case of Riyadh’s Transit-Oriented Development Program.” The general audience abstract for his dissertation is provided below.

Ibrahim has been a valued member of our Planning, Governance, and Globalization (PGG) doctoral community, where he has become known (by our undergraduates in the Smart and Sustainable Cities major) as our resident expert on Urban Footprint.

I co-chaired Ibrahim’s dissertation committee with Dr. Todd Schenk. We were joined on the committee by Dr. Robert Oliver and Dr. Hamad Alsaiari.

General Audience Abstract

Nowadays, city officials are looking outside their borders for urban policies that promote sustainability and improve quality of life. However, city officials rarely consider how differences between local urban areas could affect the adoption of urban policy. To address this challenge, the field of Urban Policy Mobility (UPM) emerged to shed light on how the unique local factors that shape each city environment affect what elements of an urban policy are or are not adopted. This study examines the changes that occurred when a Transit-Oriented Development (TOD) urban policy was introduced in Riyadh, Saudi Arabia. In order to learn about the changes and challenges of Riyadh’s TOD policy, interviews were conducted with employees responsible for the policy. Additionally, TOD policy documents and other publications that contained information about Riyadh’s TOD were reviewed to obtain additional data to help build a deeper understanding of why certain policy elements were implemented and others were not. The study found that: 1) the TOD policy was not completely translated into Riyadh where the focus is more on increasing building density, diversifying land uses, and enhancing design aesthetics, which resulted in overlooking other important policy elements that enhance economic and social sustainability; and 2) the implementation of the TOD policy led to governance challenges due to the differences in how urban planning is undertaken in Riyadh when compared with TOD policy environments in western countries. This in-depth study of Riyadh’s experience can inform other cities that are looking to implement urban policies borrowed from overseas.

TAFF Award for Best Documentary Short

Our USAID LASER PULSE team is honored to take home the prize for Best Documentary Short (Directed by Bethany Teague) at The African Film & Arts Festival (TAFF) in Dallas.

Please visit our Facebook page to learn more about the The Vegetable Connection documentary.

Visiting Professor – University of Florence

Today, I began a summer position as a visiting professor in the Department of Economics and Management at the University of Florence. During my time here I will deliver seminars on inclusive economics and Multiple Use Water Services (MUS), engage in a two-day workshop on Behavioural Ecological Economics (at the University of Florence), co-teach a summer school on Leveraging Ecological Economics to Advance the Sustainability Transition (at the University of Pisa), and co-teach a Hiking Ecological Economics Summer School (in the Apuan Alps). I’m looking forward to meeting over 100 students from across the EU, US, and beyond who have enrolled in the above activities.

Recording of VT Food, Housing, and Well-being Presentation

The recording of our presentation on Addressing Food, Housing, and Well-being at Virginia Tech: Results from the 2019 & 2021 Survey to the VT Center for Food Systems and Community Transformation, can now be accessed here.